Some Of Clark Wealth Partners

Unknown Facts About Clark Wealth Partners

Table of ContentsFacts About Clark Wealth Partners RevealedIndicators on Clark Wealth Partners You Need To KnowFascination About Clark Wealth PartnersLittle Known Facts About Clark Wealth Partners.The smart Trick of Clark Wealth Partners That Nobody is DiscussingNot known Details About Clark Wealth Partners The Main Principles Of Clark Wealth Partners 7 Easy Facts About Clark Wealth Partners Described

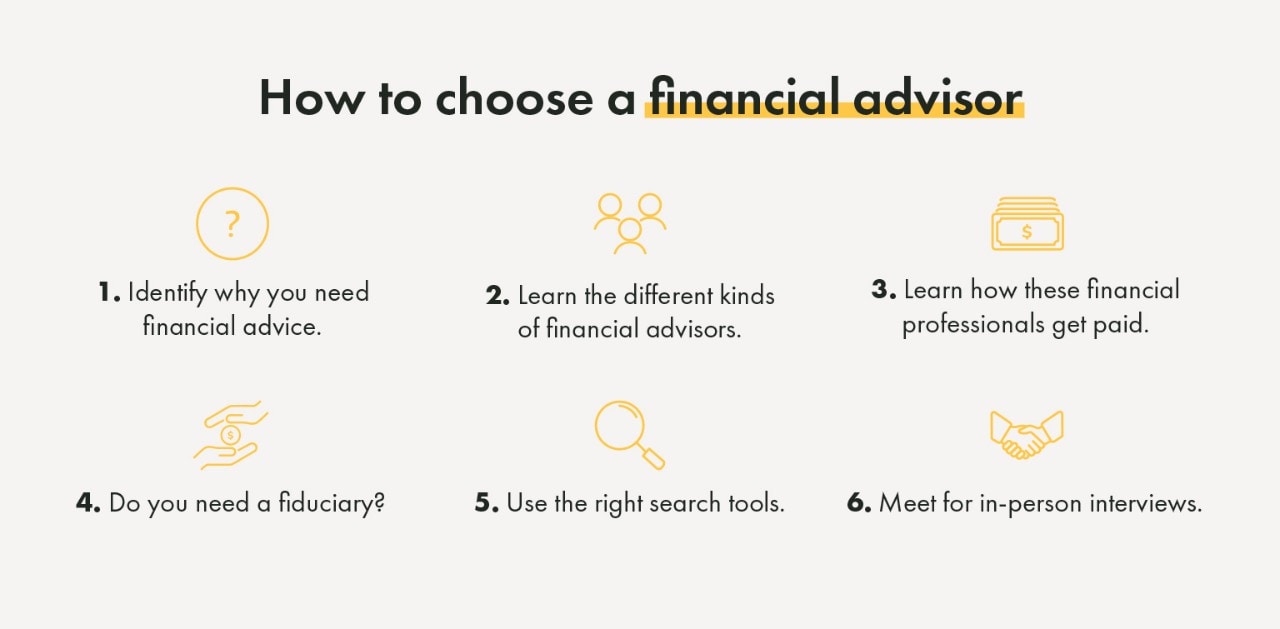

Common reasons to consider an economic advisor are: If your financial circumstance has actually come to be a lot more complex, or you do not have self-confidence in your money-managing abilities. Conserving or browsing significant life occasions like marital relationship, divorce, children, inheritance, or task modification that might considerably impact your economic situation. Browsing the transition from saving for retired life to preserving wealth during retired life and how to create a strong retired life earnings strategy.New technology has actually caused even more comprehensive automated monetary tools, like robo-advisors. It depends on you to check out and figure out the appropriate fit - https://www.twitch.tv/clrkwlthprtnr/about. Inevitably, a good economic expert must be as mindful of your investments as they are with their very own, avoiding too much fees, saving cash on tax obligations, and being as transparent as feasible about your gains and losses

Indicators on Clark Wealth Partners You Should Know

Gaining a commission on product recommendations doesn't always indicate your fee-based expert antagonizes your ideal interests. They might be a lot more inclined to recommend items and solutions on which they earn a compensation, which might or might not be in your ideal interest. A fiduciary is lawfully bound to put their client's interests initially.

This standard allows them to make suggestions for financial investments and services as long as they match their customer's goals, danger tolerance, and economic scenario. On the various other hand, fiduciary experts are legitimately obliged to act in their customer's best interest instead than their own.

Some Known Questions About Clark Wealth Partners.

ExperienceTessa reported on all points spending deep-diving into complicated financial topics, clarifying lesser-known investment methods, and revealing methods viewers can function the system to their advantage. As an individual finance professional in her 20s, Tessa is acutely conscious of the influences time and uncertainty carry your investment choices.

It was a targeted Recommended Reading promotion, and it functioned. Check out a lot more Read less.

Some Known Incorrect Statements About Clark Wealth Partners

There's no single path to becoming one, with some people starting in financial or insurance, while others begin in audit. A four-year degree supplies a strong foundation for professions in financial investments, budgeting, and customer solutions.

Unknown Facts About Clark Wealth Partners

Common instances consist of the FINRA Series 7 and Series 65 examinations for securities, or a state-issued insurance coverage license for selling life or medical insurance. While qualifications may not be legitimately required for all intending functions, companies and customers commonly see them as a standard of professionalism and trust. We take a look at optional qualifications in the following area.

The majority of economic coordinators have 1-3 years of experience and experience with monetary products, conformity standards, and direct customer communication. A solid educational background is important, however experience demonstrates the capacity to use theory in real-world settings. Some programs incorporate both, enabling you to finish coursework while earning supervised hours through teaching fellowships and practicums.

See This Report about Clark Wealth Partners

Early years can bring long hours, stress to construct a customer base, and the need to continuously verify your knowledge. Financial planners appreciate the chance to work carefully with clients, guide crucial life choices, and usually attain versatility in schedules or self-employment.

They spent less time on the client-facing side of the industry. Almost all monetary supervisors hold a bachelor's degree, and lots of have an MBA or comparable graduate level.

About Clark Wealth Partners

Optional qualifications, such as the CFP, commonly need extra coursework and testing, which can extend the timeline by a number of years. According to the Bureau of Labor Statistics, individual monetary consultants earn a typical annual annual wage of $102,140, with leading earners earning over $239,000.

In other districts, there are laws that need them to fulfill certain demands to utilize the financial consultant or economic planner titles. For economic coordinators, there are 3 usual classifications: Licensed, Individual and Registered Financial Organizer.

Things about Clark Wealth Partners

Where to locate an economic advisor will certainly depend on the type of advice you require. These establishments have team who might assist you understand and buy certain kinds of financial investments.